Gst rate on making charges of gold jewellery 2025

Gst rate on making charges of gold jewellery 2025, Titan Gitanjali TBZ rally 3 5 post cut in GST rates for jewellery making charges 2025

$0 today, followed by 3 monthly payments of $13.33, interest free. Read More

Gst rate on making charges of gold jewellery 2025

Titan Gitanjali TBZ rally 3 5 post cut in GST rates for jewellery making charges

GST rates GST impact on gold jewellery Larger players to emerge as biggest beneficiaries

Are Jewellers fooling you In the case of gold Jewellery both the Jewellery and making charges are chargeable at a 3 GST rate as they are a composite supply. gold gold jewellery goods and

How Much GST is Applied to Gold Jewellery in India The Caratlane

How Much GST is Applied To 22 Carat Gold in India Bajaj Finance

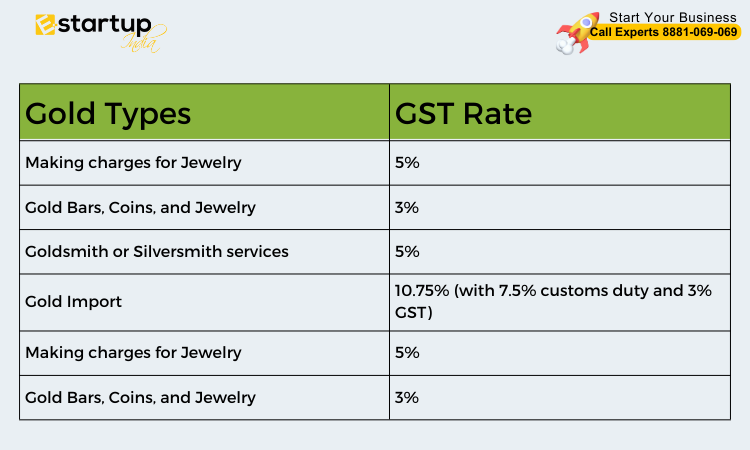

GST Registration Effects of Gold GST Rate in India 2024 E Startup India

uweed.fr

Product Name: Gst rate on making charges of gold jewellery 2025GST Registration Effects of Gold GST Rate in India 2024 E Startup India 2025, GST Impact On Gold Impact of GST on gold and gold jewellery prices Times of India 2025, Gst percentage of deals gold 2025, Gold GST Rate GST 2025, GST on Gold Effects of Gold GST Rate in India 2024 2025, GST On Gold in India in 2024 GST Rates on Gold Jewellery Purchases 2025, Gst on sale purchase of gold 2025, GST On Gold In 2022 Check Tax Rates HSN Codes Here 2025, GST on Gold Effects of Gold GST Rate in India 2024 2025, GST on Gold GST Impact on Gold Making Charges GST Paisabazaar 2025, GST rate on jewellery making charges cut to 5 from 18 stocks jump up to 3 Industry News The Financial Express 2025, GST on Gold Jewellery Making Charges 2022 Bizindigo 2025, GST on Gold Jewellery Goyal Mangal Company 2025, GST on Gold coins making charges HSN code GST PORTAL INDIA 2025, The GST on gold ornaments is 3 of the total value of the gold jewellery. This includes both the value of the gold and any making charges. This rate is charged as a total of CGST and SGST which is 2025, Gold GST Rate Archives BIZINDIGO 2025, GST on Gold Jewellery Gold Jewellery GST GST on Making Charges of Gold Jewellery 2025, Calculating The Accurate Gold Jewellery Price Jewellery Blog 2025, GST on Gold How the Gold GST Rate Affects Gold Industry in India 2025, GST Council cuts tax rate on gold jewellery making charges to 5 BusinessToday 2025, Save Immediately Gold Jewellery Fraud In India the Goods and Services Tax GST rate for gold is 3 However for making charges the GST rate is 5 But gold jewelry is considered a 2025, How Much GST is Applied to Gold Jewellery in India The Caratlane 2025, Golden Tips Be savvy about making charges when buying jewellery this Diwali 2025, What is the Impact of GST on Gold in India GIVA Jewellery 2025, GST Registration Effects of Gold GST Rate in India 2024 E Startup India 2025, GST on Jewellery Business Goyal Mangal Company 2025, Gold Jewellery HSN Code GST Rates for Gold IndiaFilings 2025, Avail Zero Making Charges on Gold Jewellery GIVA Jewellery 2025, Impact of GST on Gold And Gold Jewellery Prices Buy Now or Later 2025, Gold jewellery Only Gold rate no any making charges and gst tax Women 1788563984 2025, Titan Gitanjali TBZ rally 3 5 post cut in GST rates for jewellery making charges 2025, GST rates GST impact on gold jewellery Larger players to emerge as biggest beneficiaries 2025, Are Jewellers fooling you In the case of gold Jewellery both the Jewellery and making charges are chargeable at a 3 GST rate as they are a composite supply. gold gold jewellery goods and 2025, How Much GST is Applied to Gold Jewellery in India The Caratlane 2025, How Much GST is Applied To 22 Carat Gold in India Bajaj Finance 2025.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Gst rate on making charges of gold jewellery 2025

- gst rate on making charges of gold jewellery

- gst rate on silver

- gst rate on silver coins

- gst rates on jewellery

- gst rate on silver ornaments

- gst s100

- gst s100d

- gst s100g

- gst s100g price

- gst s110d